In this FICO configuration activity you are able to maintain depreciation key where you can assign calculation methods per depreciation key.

Transaction: AFAMA

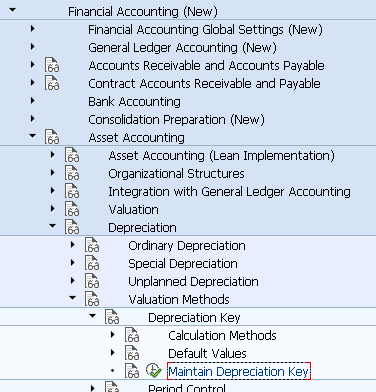

IMG Path: Financial Accounting (New) -> Asset Accounting -> Depreciation -> Valuation Methods -> Depreciation Key -> Maintain Depreciation Key

Tables: T090NAZ, T090ND, T090NDT, T090NP, T090NPT, T090NR, T090NRT, T090NSG, T090NST, T090NA, T090NAT, T096, T096T, T091,T091T, T090NH_METH, T090NHT

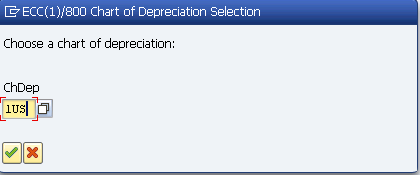

Initially, you will have to choose chart of depreciation.

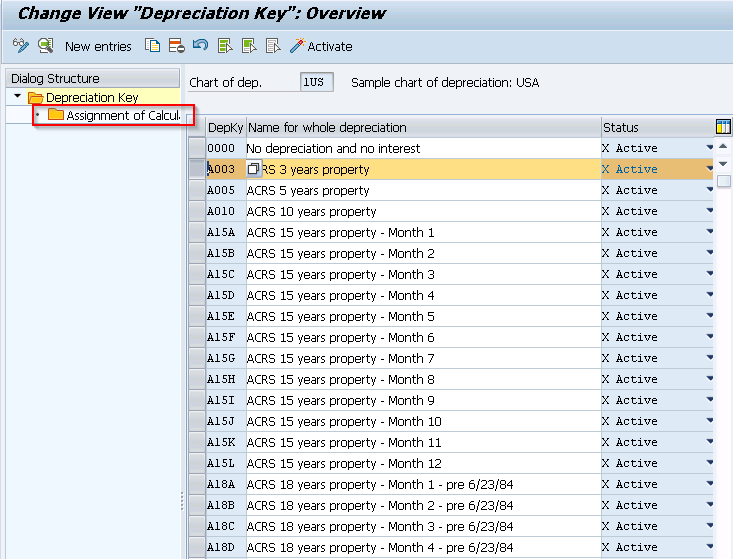

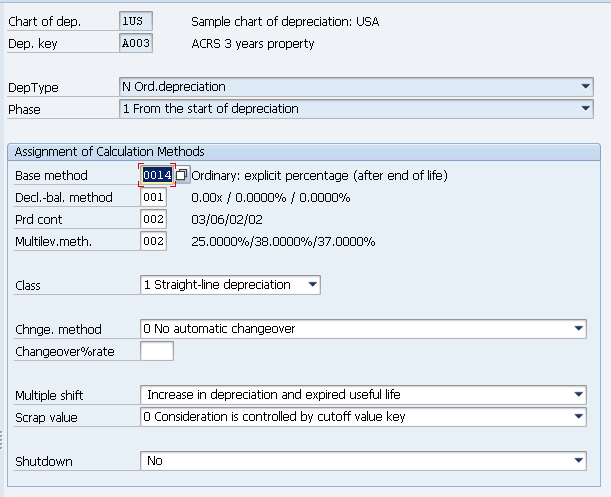

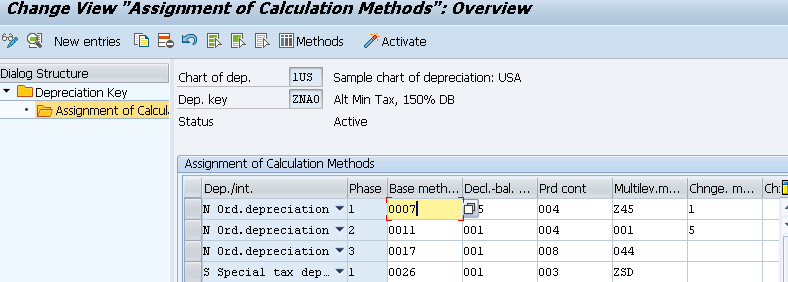

On the main screen you will see a list of depreciation keys. Choose one and then jump to assignment of calculation.

If you have one entry, then you will see directly detailed view.

If you have more assignments for the selected depreciation key, you could see following summary view.

ETCircle.com SAP FI and CO consultant information

ETCircle.com SAP FI and CO consultant information

Awesome presentaton

There is an issue.

Asset is disposed in sep. But deprecation is calculating for remaining periods of the year. which should be zero. please suggest.

where to check configuration settings and also why its calculating negative values dep for remaining periods.

thank you