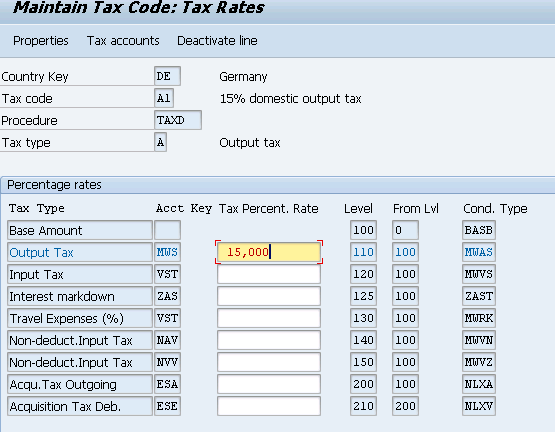

Here you are able to define the tax calculation percentages based on combination of tax code, tax procedure and country.

Transaction: FTXP

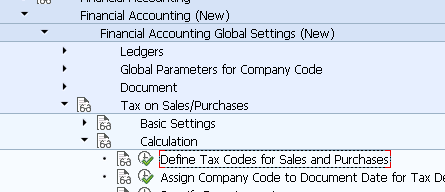

IMG Path: Financial Accounting (New) -> Financial Accounting Global Settings (New) -> Tax on Sales/Purchases -> Calculation -> Define Tax Codes for Sales and Purchases

Table: T004, T007A, T007S, T007V

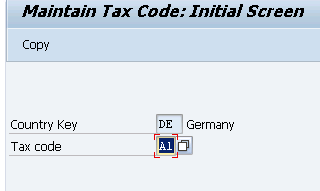

On the first screen you have to choose the country for which you will change the tax codes.

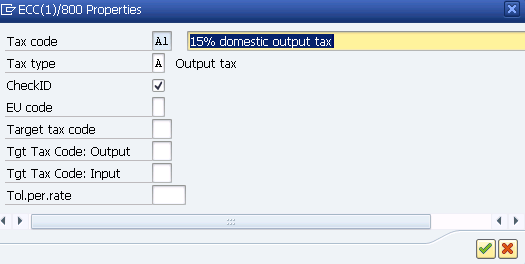

On the following screen you have to choose a tax code and hit “Enter” or use the Copy function to create a new one. You are also able to create new Tax Code by entering manually the name of it and then hit “Enter”. You will directly go to “Properties” screen of the new tax code where you will have to define whether it is output or input for example.

Here, you will have to define the percentage rate.

Following are what options we have in properties area.

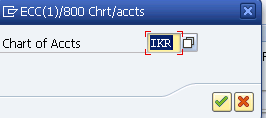

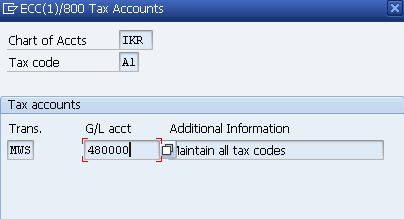

If we click on “Tax Accounts”, we have to select our chart of accounts first.

On the screenshot below you will see the G/L Account for that particular tax code.

ETCircle.com SAP FI and CO consultant information

ETCircle.com SAP FI and CO consultant information