SAP is coming with tax procedures for every major country, but there could be cases where you have to define or change custom one. It is not advisable to change default tax procedures as they are updated by SAP patches.

Transaction: OBYZ

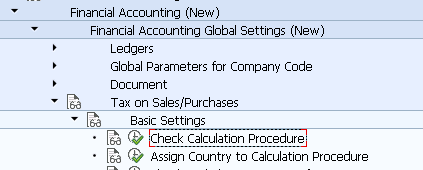

IMG Path: Financial Accounting (New) -> Financial Accounting Global Settings (New) -> Tax on Sales/Purchases -> Basic Settings -> Check Calculation Procedure

Tables: T682Z, T682I, T682, T683, T683S, T685A

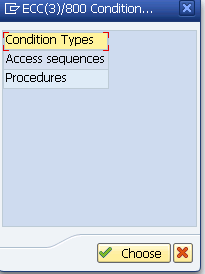

If you start the transaction by typing OBYZ, then you will get following pre-selection screen.

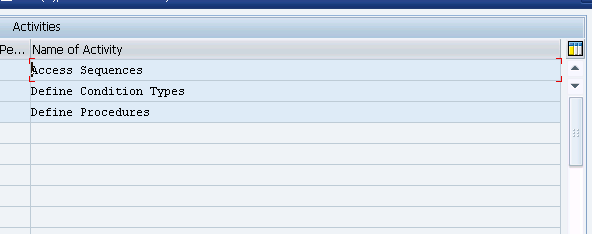

If you use the IMG Menu, you wills see following on ECC6 EHP6.

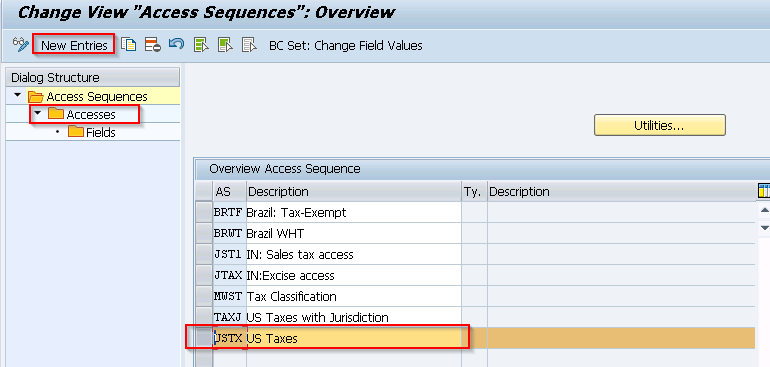

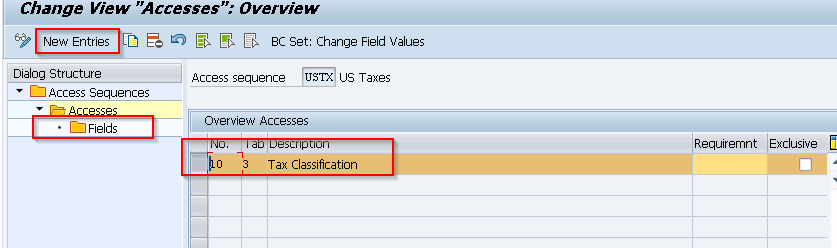

We will start with Access Sequences. Check Accesses.

Following is a screenshot for Accesses area.

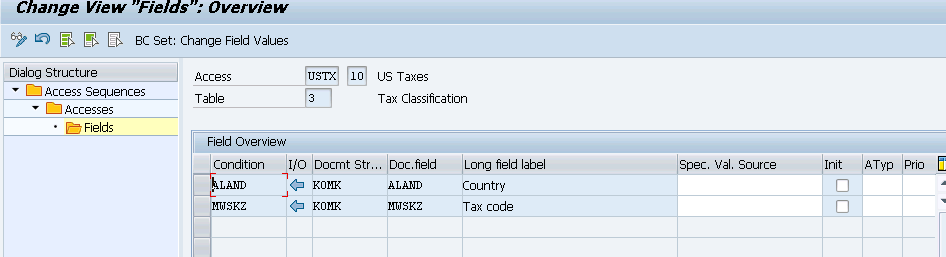

Fields Area in Access Sequences step.

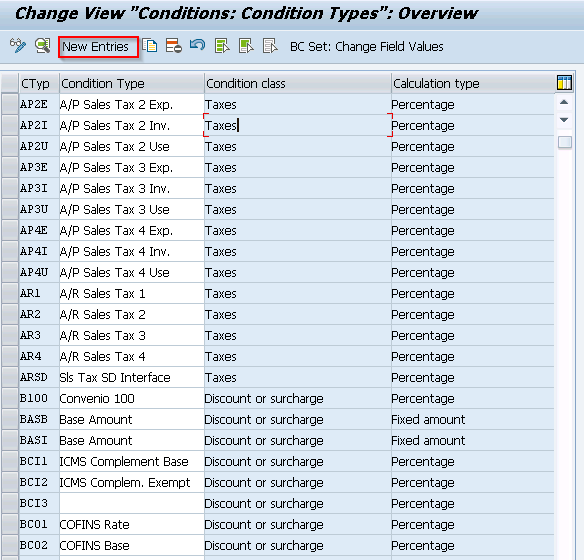

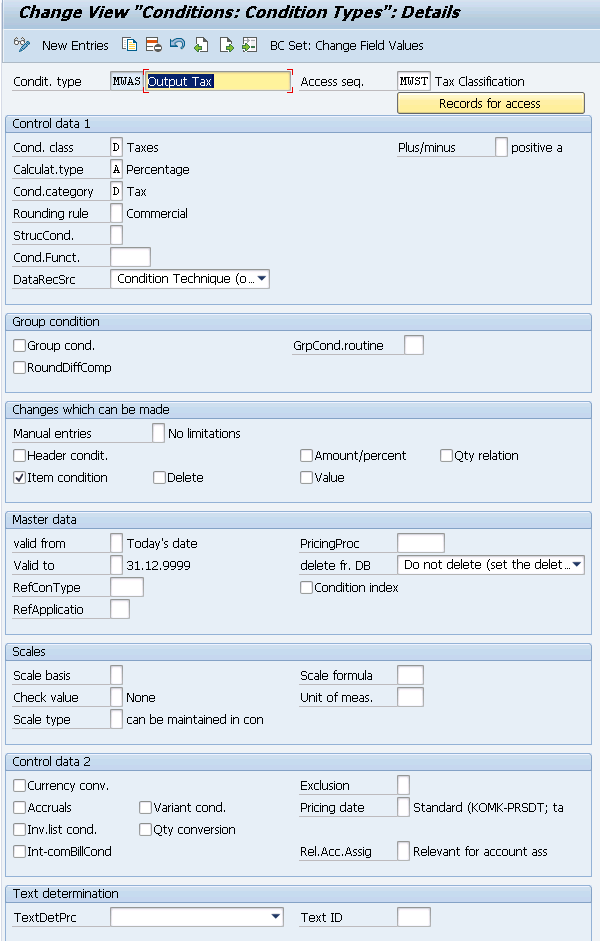

Next step is Condition Types. In first screen you will get a list with all condition types. Double click on particular condition type or create a new by “New Entries” button.

Following is a screenshot of the pre-delivered MWAS condition type.

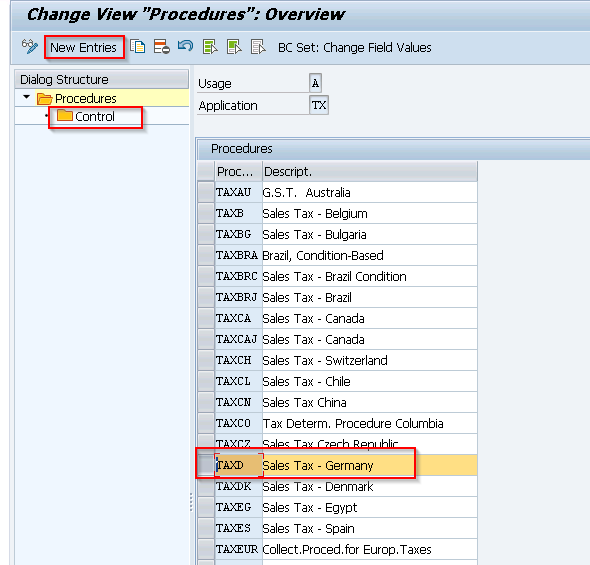

Next step is to use the sequence and condition types in Tax Procedures.

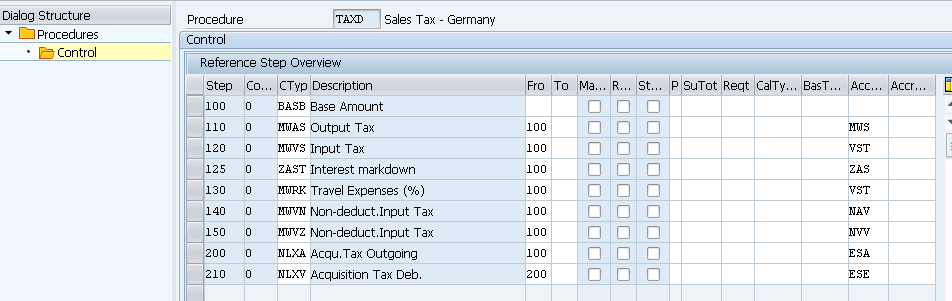

Next is the Control screen from Tax Procedures.

ETCircle.com SAP FI and CO consultant information

ETCircle.com SAP FI and CO consultant information