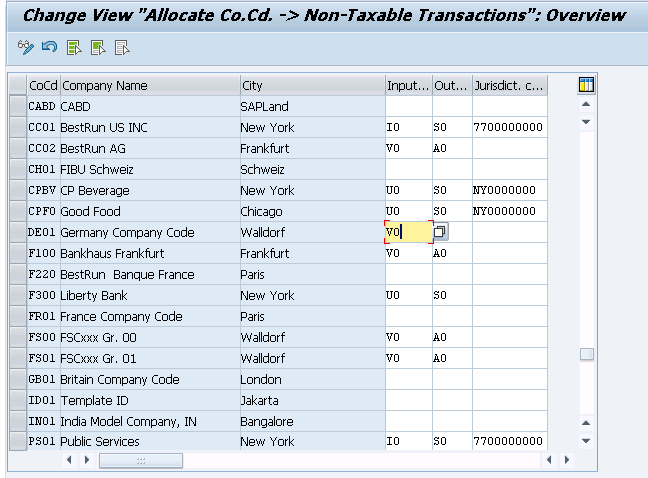

In this transaction you should assign tax codes which will be used for non-taxable transactions. Almost every country has business and/or government transactions for which not input or output tax should apply.

Transaction: OBCL

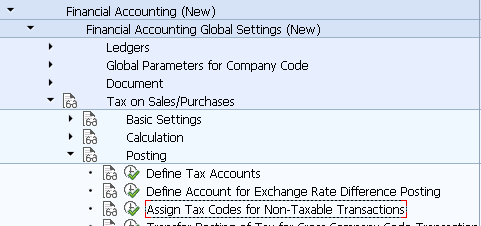

IMG Path: Financial Accounting (New) -> Financial Accounting Global Settings (New) -> Tax on Sales/Purchases -> Posting -> Assign Tax Codes for Non-Taxable transactions

Table: T001

When you open the transaction, find your company code and assign tax codes for input and output taxes as well as enter an jurisdiction code if such is necessary.

ETCircle.com SAP FI and CO consultant information

ETCircle.com SAP FI and CO consultant information